IES Viewpoint: When can we expect some light at the end of the UK jobs tunnel?

1 Sep 2013

Nigel Meager, Director

We last looked at the state of the UK labour market in this column just over two years ago. We noted then that there was little sign of a return to prerecession unemployment levels. Two years on, we can perhaps be forgiven a certain Groundhog Day feeling.

We last looked at the state of the UK labour market in this column just over two years ago. We noted then that there was little sign of a return to prerecession unemployment levels. Two years on, we can perhaps be forgiven a certain Groundhog Day feeling.

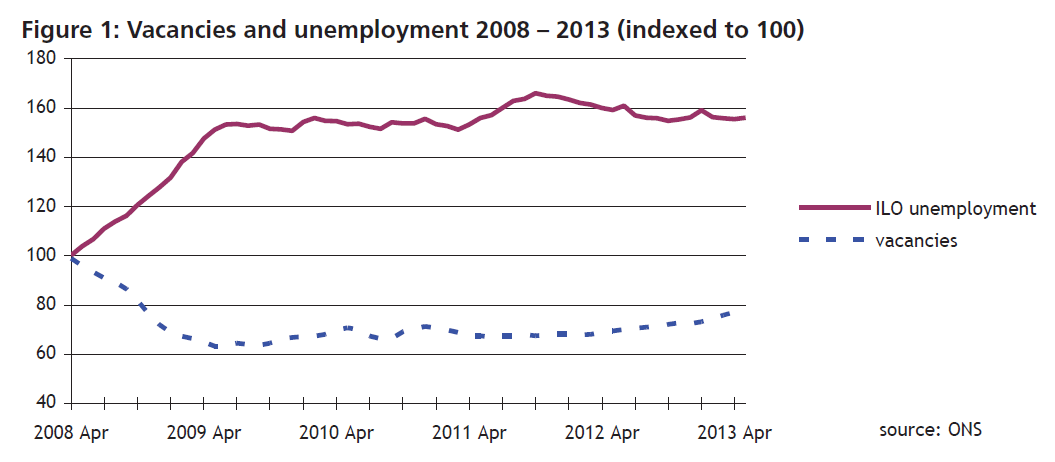

The jobs market has been stuck in a state of prolonged demand-deficiency for over four years. The graph below shows what has happened to two key indicators of labour demand – unemployment and unfilled vacancies – since the start of the recession in early 2008. Although commentators and journalists get excited about month-to-month movements in the employment and unemployment figures, the graph shows clearly that not much has happened to the tightness of the labour market since spring 2009. In the first year of the recession, unemployment shot up by just over 50 per cent (from around 1.6m to nearly 2.5m), and with relatively small fluctuations, that’s where it’s still stuck now (just over 2.5m). Similarly, unfilled vacancies, movements in which are a key indicator of trends in the demand for labour, fell by nearly 40 per cent over the first year of the recession, and have more or less stuck there ever since (the slight upward trend in the last few months not withstanding).

None of this is surprising, given the prolonged downturn in GDP since the financial crisis of late 2007. This economic performance is unprecedentedly dire. In both of the previous two recessions, GDP recovered to its prerecession level within three years. This time it’s different: we are five and a half years into the downturn, and although GDP has started to pick up, it’s still an astonishing 3.2 percentage points below its 2008 level. It is telling that the anaemic and faltering GDP growth in the past two quarters is being talked of by some politicians and commentators in glowing terms. While we should remember that government policy weakness did not cause the initial crisis (that was entirely down to the behaviour of the banks), it is likely that the subsequent five-plus ‘lost years’ of economic downturn will in time come to be seen as a failure in macro-economic policy of historic proportions.

What does all this mean for the prospects of the UK labour market? Although our graph shows little change in the last couple of years, we have nevertheless during those two years learnt a bit more about the unusual recent behaviour of employment. It’s unusual because, given what’s been happening in the macro-economy, we would have expected the unemployment situation (bad though it is) to have been much, much worse. Rather than stabilising and then chugging along at around 2.5 million, if the relationship between GDP and unemployment had been similar to that seen in previous recessions, it would have continued to soar to well above 3 million, probably higher. There are several reasons for the labour market performing less badly than we might have expected. First, to give credit where credit is due, this is one area where government policy has made a positive difference; the more ‘active’ approach to engaging with the unemployed, introduced in the 1990s and extended by more recent administrations, has clearly helped to keep many unemployed people closer to the labour market, and get them back to work more quickly than was the case in earlier periods. Even more important, however, is the role played by the UK’s much vaunted ‘flexible labour market’. In the most recent recession, to a much greater extent than in previous downturns, employers and employees have agreed deals on wage levels and working time which have made it possible for more people to remain in work than would otherwise be the case. This has been partly facilitated by a shifting balance of power in the labour market; one indicator of this is the historically low level of union membership and coverage of collective bargaining. How positive this is overall is a matter of perspective: on the one hand employment is higher and unemployment lower than they would be otherwise; on the other hand there’s been an unprecedented downward squeeze on real wages, and there are record levels of involuntary part-time workers (who’d prefer to be working for longer hours if the work were available). The recent outcry over ‘zero-hours contracts’ is a symptom of this trend.

Looking ahead, the sting in the tail is that as national output growth continues to pick up, it may take some time for this to cause unemployment to drop to pre-recession levels. Many employers have considerable scope to respond to increased demand without a proportional increase in the number of people employed, simply by increasing the working hours of their existing workforces, many of whom (the survey evidence suggests) are keen or desperate to increase their working time. It is of interest to note that the latest labour market statistics published by ONS in August 2013 show that whereas during the past year employment has increased by one percent, total hours worked in the economy have increased twice as fast (by two percent). An additional factor may come from pent-up pressure for increased wages; as economic growth resumes, employers may find it harder to resist this pressure, and any inevitable real wage catch-up will further dampen any positive impact of growth on employment levels. The new Bank of England Governor, Mark Carney, recently announced that interest rates will remain at their current low levels until the unemployment rate falls back below 7 per cent. This may take a while.