Labour Market Statistics, June 2025

10 Jun 2025

Seemanti Ghosh, Principal Research Fellow (Economist)

Seemanti Ghosh, Principal Research Fellow (Economist)

This briefing sets out analysis of the Labour Market Statistics published this morning. Today’s LFS data covers the period from February to April 2025. While we discuss the numbers released today, we also briefly review these numbers in the context of recent policy discussions and share our thoughts about the future.

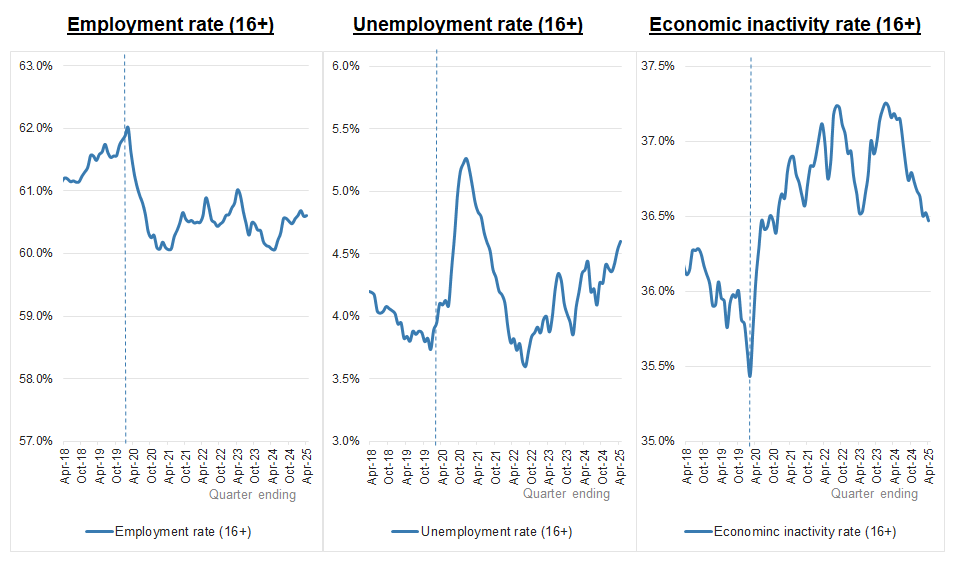

The unemployment rate has reached the highest level in almost four years, since May-July 2021. The employment rate remains below its pre-pandemic level, though there are signs of a recent improvement in the overall number of people in work. Employment and inactivity have both modestly improved on the quarter for the 16 to 64 age group, while unemployment has worsened. This indicates that while more people are joining the workforce, finding work is becoming increasingly difficult.

Employment: The UK employment rate for people aged 16 and over was estimated at 60.6% in February to April 2025. That is 667,000 more people than a year ago and 89,000 more people than the last quarter. This translates to an increase in the employment rate of 0.5% on year and no change on the quarter. The UK employment rate for people within the 16 to 64 age group was estimated at 75.1% in February to April 2025. That is 562,000 more people than a year ago and 88,000 more people than the last quarter. This translates to an increase in the employment rate of 0.7% on the year and a modest 0.1% on the quarter.

Unemployment: The UK unemployment rate for people aged 16 and over was estimated at 4.6% in February to April 2025. That is 115,000 more people than a year ago and 94,000 more people than the last quarter. This translates to an increase in the unemployment rate of 0.2% both on the year and on the quarter. The UK unemployment rate for people within the 16 to 64 age group was estimated at 4.7% in February to April 2025. That is 112,000 more people than a year ago and 80,000 more people than the last quarter. This translates to an increase in the unemployment rate of 0.2% both on the year and on the quarter.

Inactivity: The UK inactivity rate for people aged 16 and over was estimated at 36.5% in February to April 2025. That is 176,000 less people than a year ago and 36,000 less people than the last quarter. This translates to a decrease in the inactivity rate of 0.7% on year and 0.2% on the quarter. The UK inactivity rate for people within the 16 to 64 age group was estimated at 21.3% in February to April 2025. That is 303,000 less people than a year ago and 80,000 less people than the last quarter. This translates to a decrease in the inactivity rate of 0.9% on the year and 0.2% on the quarter.

Figure 1: Employment, unemployment and economic inactivity rates (%)

Source: Labour Force Survey. Vertical dotted line indicates start of first Covid-19 lockdown.

Vacancies and payrolled employees continue to fall

Today’s labour market data shows that 14 out of the 18 industry sectors have witnessed a quarterly fall in vacancies. We observe a notable quarterly fall in the number of vacancies in total services (45,000), professional services (11,000), construction (9,000) and manufacturing (8,000). Overall, the estimated number of UK vacancies was 736,000 between March to May 2025, indicating a decrease of 63,000 (approx. 8%) on the quarter and 150,000 (approx.17%) on the year. This was the 35th consecutive quarterly decline.

The total number of payroll employees has decreased by 55,000 (0.2%) between March and April 2025 and by 115,000 (0.4%) on the year. The provisional estimate of payrolled employees for May 2025 decreased by 109,000 (0.4%) on the month, however these numbers will be verified next month. Payrolled employees have decreased in 14 out of 20 sectors between March to April 2025, with the highest decrease observed in professional services (18,000), followed by construction (16,000) and accommodation and food services (10,000).

Pay growth is accelerating but lower than a year ago

Both regular pay (excluding bonuses and arrears) and total pay appear to be rising. Annual growth in employees' average regular earnings excluding bonuses in the UK was 5.2% in February to April 2025, and annual growth in total earnings including bonuses was 5.3%. Growth in regular pay in the public sector is higher (5.6%) compared to the private sector (5.1%) for February to April 2025. Overall, regular pay growth is 0.7% lower than a year ago. Annual growth in real terms, adjusted for inflation using CPIH, was 1.4% for regular pay and 1.5% for total pay in February to April 2025.

Today’s figures show the first labour market data since the rise in National Insurance contributions (NICs) and the National Living Wage (NLW). The combined figures indicate that employers have adjusted to rising costs by reducing their workforce size and future workforce planning. The sectors that have witnessed the largest decrease in workforce and vacancies are hospitality, professional services and construction. Two out of the three sectors (services and construction) are labour intensive and highly likely to have been impacted by rising employer costs.

These sectors also have a higher proportion of entry level jobs and therefore pose a threat to young people’s employment since these are routes where young people enter. The professional services sector may have been affected by multiple factors such as economic uncertainty, anticipated reduction in investment in R&D and a shift towards automation and augmentation due to the impact of Artificial Intelligence, alongside rising employer costs.

Overall, the combined figures suggest a cooling labour market in the UK, where employers are clearly hesitant to invest in workforce expansion. Although the data may partially reflect broader global uncertainty, it is evident from today’s statistics that employers are struggling with rising costs, which raises immediate wider policy concerns. Given the upcoming Spending Review that is expected to provide a big boost to sectors such as infrastructure that can improve vacancies in construction, this is an urgent call for the government to get us back on the path to growth by finalising its industrial strategy.