A snapshot of the UK employment indicators

27 Nov 2024

Nick Litsardopoulos, Research Economist (Fellow)

This blog was originally published in October 2024 on the website of Adzuna, one of the largest online job search engines in the UK.

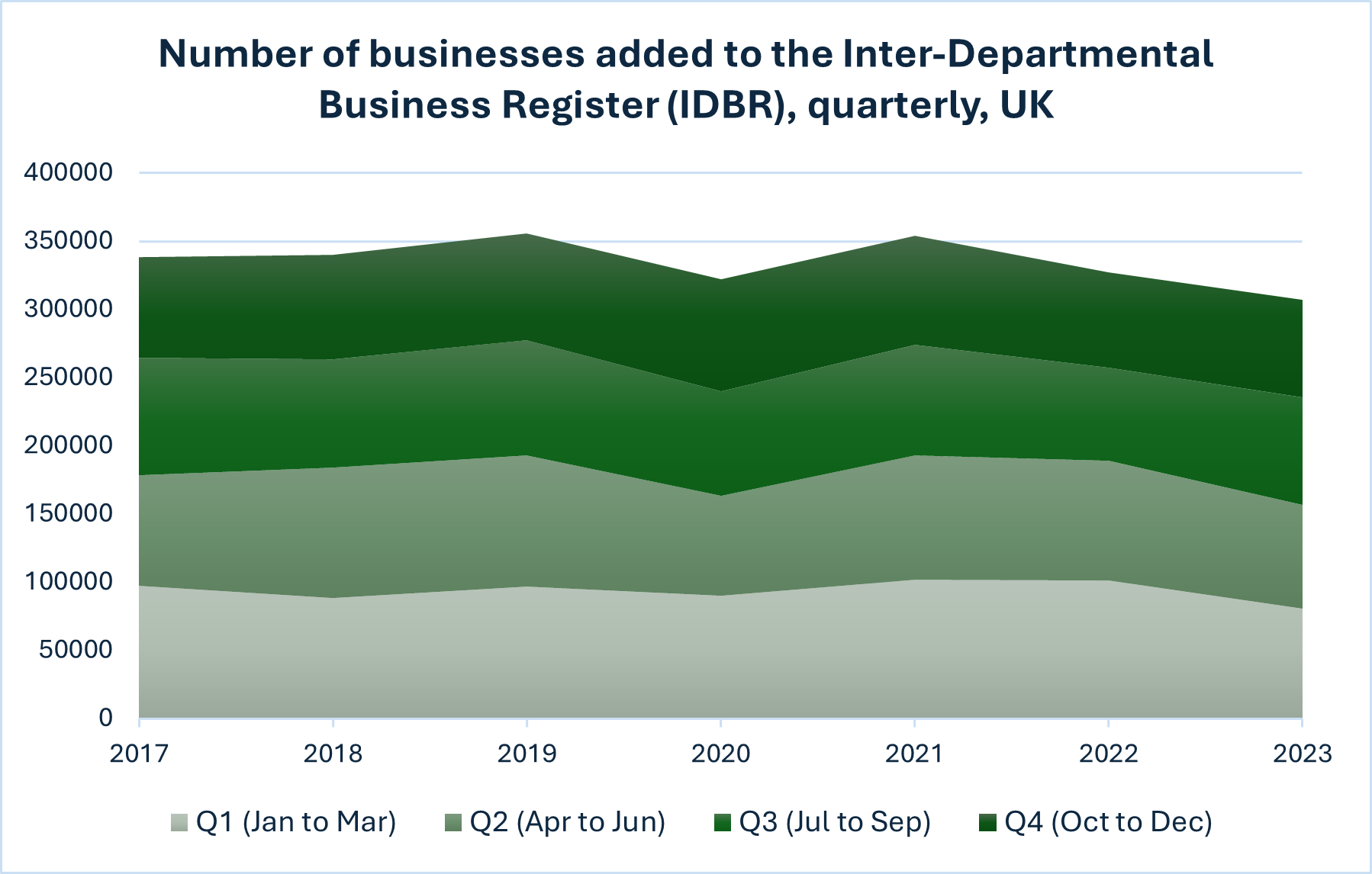

There has been a growing anxiety about the state of the UK labour market and the business activity of the country. The UK has experienced a decade of political turbulence (e.g. Brexit), with five different Prime Ministers (PM) in the past eight years (i.e., a new PM every 1.6 years on average). This coincided with a period of rapid technological change and the impact of the increasing application of Artificial Intelligence (Ai) tools across industries. The amalgamation of all these has created an environment of uncertainty that has negatively affected the investment in infrastructure projects, research and development projects, and quality of public services, among others. The resulting uncertainty has had an impact on the market with business creation slowing down and along with it a fall in job vacancies after April 2022 when the new legislation regarding the Right to Work in the UK came into effect.

The 2022 Right to Work legislation in the UK has significantly impacted hiring practices, building on previous changes following Brexit. The new legal landscape has undermined the normative value of the right to work, exacerbating flaws in domestic employment rules for both national and migrant workers. This became particularly burdensome for the National Health Service (NHS), which is the largest employer in the UK. Nevertheless, a similar decrease of hiring has been observed in most occupations according to the number of job vacancies advertisements.

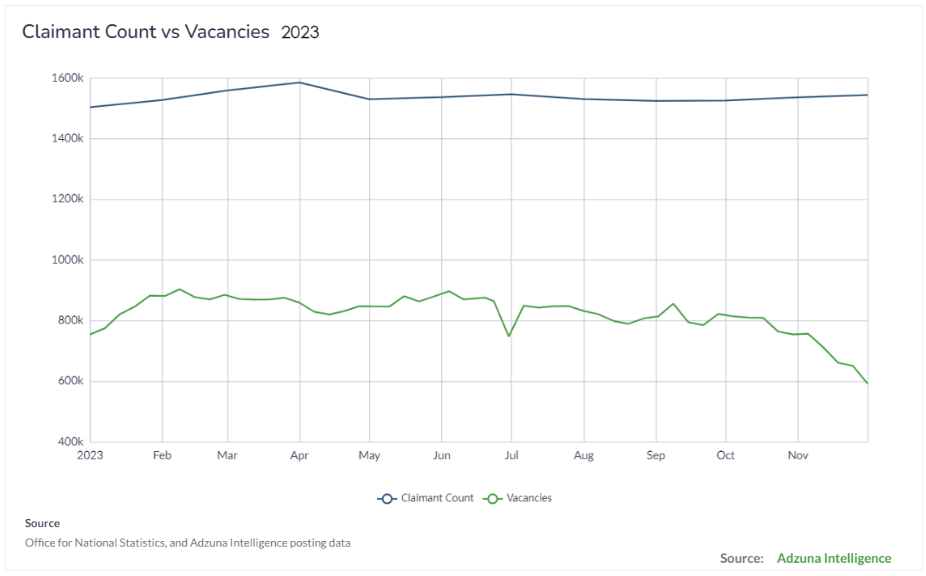

Using the Adzuna Intelligence Portal we can access Economy Intelligence information about the advertised job vacancies in the UK, alongside information from Office for National Statistics, Annual Population Survey. This handy feature of the Adzuna portal allows for a rather comprehensive view of the state of the UK’s labour market. One of the striking pieces of information shown is the Claimant Count vs Vacancies chart for 2023.

What it reveals is that the job vacancies advertisements have been falling during 2023 after a short increase during the first couple of months of the year. At the same time the job seeker allowance claimant count shows a small uptick in the last few months of the year, after a relative stabilisation at a lower level since April last year.

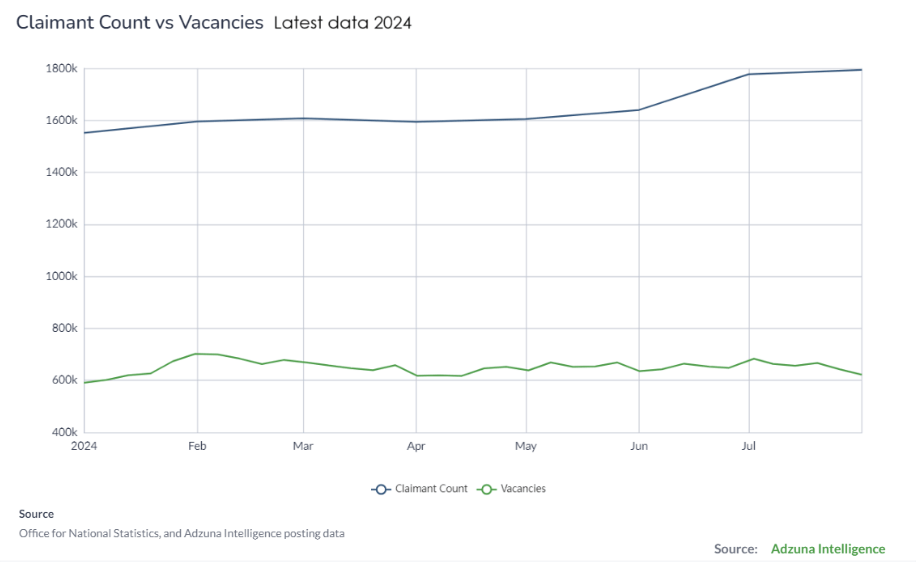

When looking at the most recent data of 2024 available on the Adzuna portal, we see that the number of job seeker allowance claimants has continued rising to 1.8 million people, up by 200,000 from the 2023 peak of 1.6 million people. At the same time, the fall in advertised job vacancies seem to have slowed, gravitating now just above 600,000 (see chart below). All in all, this suggests a gap in the jobs market of about one million jobs, or seen in a different way, there are 0.4 jobs vacancies advertised for every job-seeker claimant.

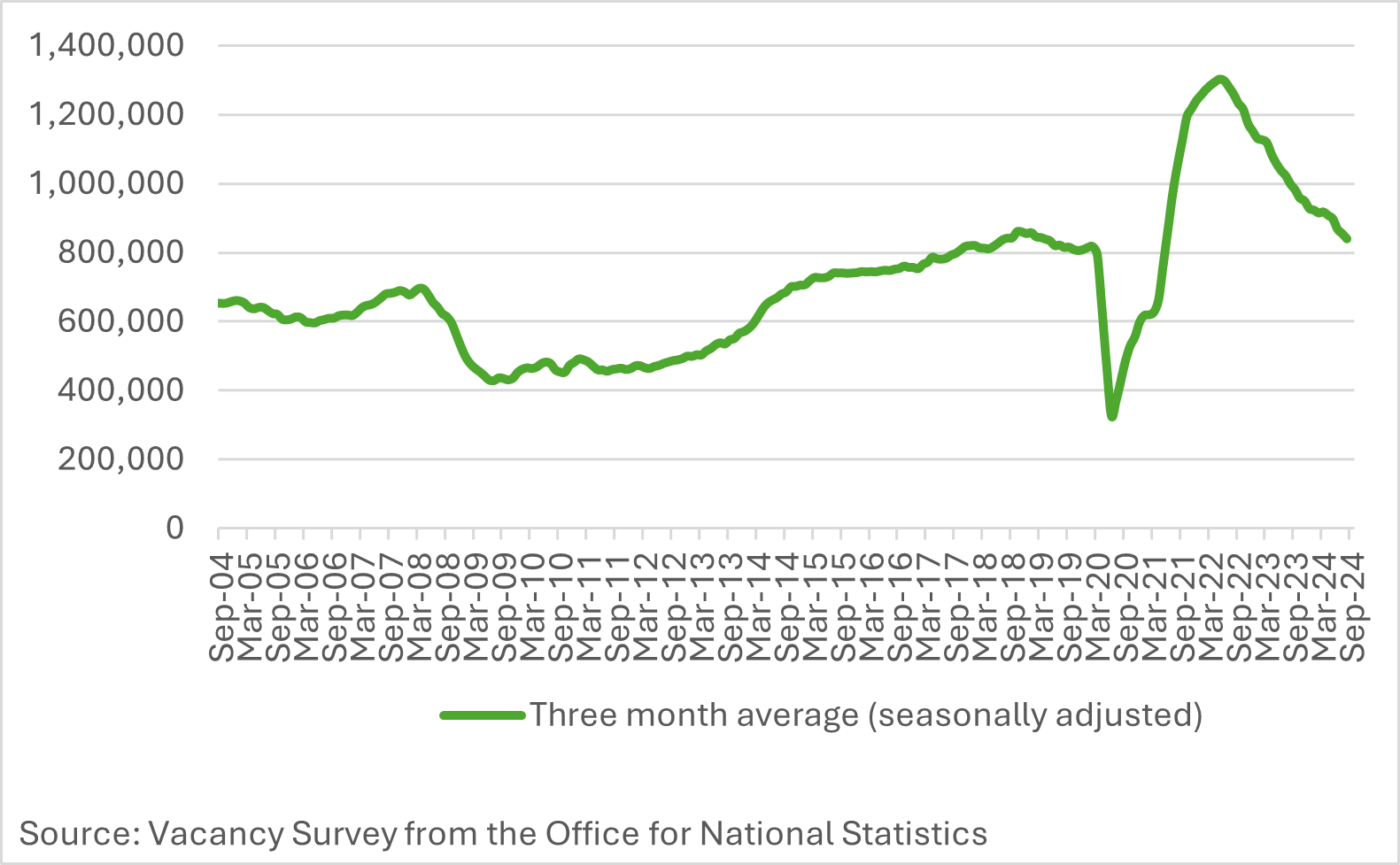

If we expand the data coverage to identify the last time the UK jobs market experienced a convergence peak, that is, Nov 2021. We can see that the job-vacancies advertisements steadily declining whilst the claimant count trend has reversed and is again increasing after reaching a plateau around 1.5 million claimants. In a recent analysis of the October 2024 ONS Labour Market Statistics, the Institute for Employment Studies (IES) also highlighted the alarming trend in the decreasing vacancies, regardless of the improved labour market conditions suggested by other traditional indicators, such as employment and unemployment rates. The latest ONS vacancy data point to a further quarterly fall that has brought the number of official vacancies count to 843 thousand, which is a new low since April-June 2021.

The ONS Vacancies and Jobs in the UK: October 2024 bulleting confirms the falling trend, pointing out that “Vacancy numbers decreased on the quarter for the 27th consecutive period in July to September 2024, with vacancies decreasing in 15 of the 18 industry sectors”. The Oct 2024 data release indicates that since the recent highs of May 2022, there are 463 thousand job vacancies available across the 18 industry sectors surveyed. ONS estimates a ration or 1.6 vacancies per unemployed person.

This was the 27th consecutive quarterly fall in the number of vacancies. Nevertheless, looking at the past 12 months change it becomes evident that there are only two industries that registered an increase, that is Construction and Real Estate, which arguably are not too unrelated. It worths noting that the overall vacancies are still higher than the pre-pandemic period of January to March 2020, with two industry sectors having experienced the largest increase since then being the Human health and social work activities, along with the Professional, scientific and technical activities, which are up by an estimated 13,000 and 16,000 vacancies, respectively. It may not be surprising to see vacancies, for example, in Human health and social work activities have fallen the most in recent times, suggesting a possible ongoing correction.

All told, the recent October ONS labour market overview figures show that there are fewer job openings now than in recent years, but that there remain areas of high demand alongside those where demand is falling faster. And with unemployment back close to historic lows, this may s reiterate the need to do more to help raise participation in the labour force for those who are willing to work but find it difficult to secure a job.

Any views expressed are those of the author and not necessarily those of the Institute as a whole.