Why Bolsover could be the next Port Talbot

22 Mar 2024

Daniel Muir, (former) Research Economist (Fellow)

Nick Litsardopoulos, Research Economist (Fellow)

This blog was originally published on the website of Adzuna, one of the largest online job search engines in the UK.

In January, it was announced that Tata Steel would be closing its blast furnaces in Port Talbot. This sparked discussion about the continued changes to Britain’s industrial mix, its importance for national security, and the sacrifices that need to be made in pursuit of Net Zero. Underneath all these big picture debates though, this news will have hit the people of Port Talbot the hardest. The steel works was a major employer in the area, providing both a key source of employment and some relatively high quality, high paying job opportunities as well.

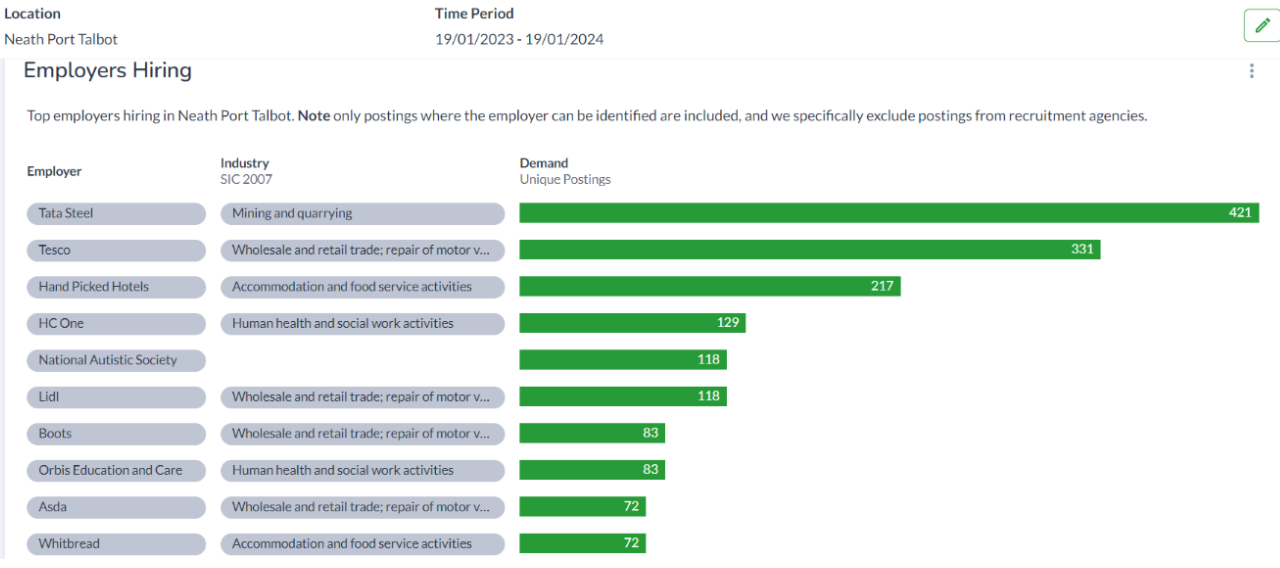

Taking a look at Adzuna’s intelligence portal, their proprietary dashboard that displays a wide range of aggregate statistics based on job postings data, we can see just how important Tata Steel was within Port Talbot’s labour market.

The chart below shows that in the year leading up to the announcement, Tata Steel was by far the top hiring employer in the area, holding 421 vacancies which was around 27% more than Tesco, the second top hiring employer.

In addition to this, it was largely the only major hiring employer outside of the retail, hospitality and care industries, i.e., typically lower paying industries with roles largely concentrated at the lower end of the skills spectrum.

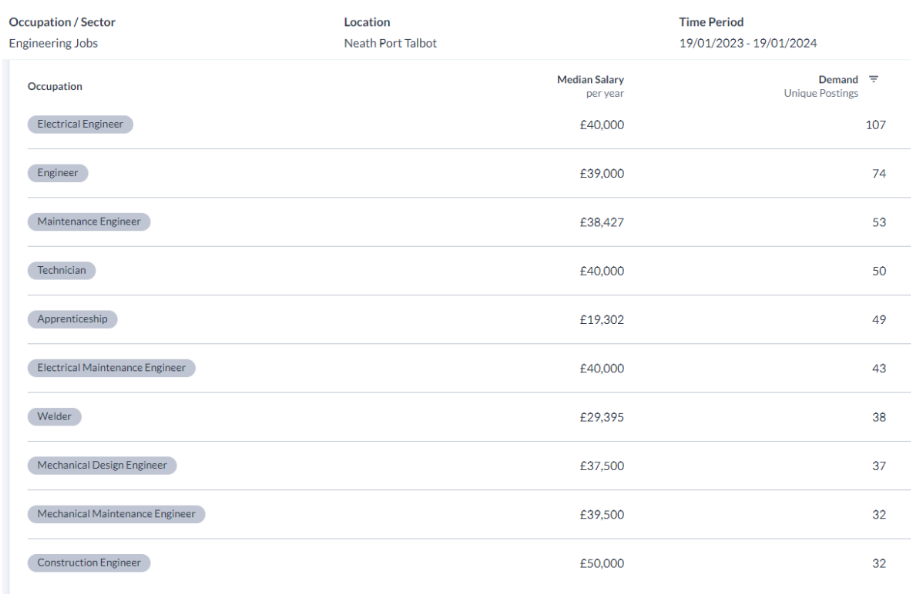

The engineering sector (which Tata Steel operated in) also typically contains a lot of apprenticeship opportunities, meaning great pathways from education into high quality careers for young people.

The table below shows the main occupations being hired for in the engineering sector in Port Talbot over the same period, dominated by Tata Steel. These were largely relatively high paying and highly skilled positions.

On the year, this means that average salaries of vacancies is down 4% in Port Talbot, compared to 6% growth across the UK as a whole. For more information on how Tata Steel’s closure in Port Talbot can be seen in Adzuna’s data, see here comment from Tony Wilson, Director of the Institute for Employment Studies.

This news thus highlights how vulnerable local labour markets can be to the activity of individual employers or single industries. So we decided to take a look at which other local areas are also dominated by certain industries and employers, to highlight where policymakers may need to pay particular attention in developing Britain’s industrial strategy and policy focused on regional economies.

Vulnerable local labour markets beyond Port Talbot

One source of information on this is the Business Register and Employment Survey, which provides information on employment by industry at the local level.

Consulting the 2022 dataset, we can see that manufacturing (i.e., the industry that Tata Steel operates within) accounted for 18% of employment in the area, more than double the proportion across the UK as a whole (8%). Additionally, there are 8 instances where a single industry accounts for more than 30% of employment within a local authority:

- Manufacturing – Barrow-in-Furness (33.3%), Copeland (34.4%)

- Human health and social work activities – Knowsley (30.3%)

- Administrative and support service activities – Luton (32.4%), Dacorum (44.4%)

- Financial and insurance activities – City of London (32.4%)

- Education – Oxford (31.1%)

- Hospitality – Isles of Scilly (48.0%)

Naturally, the extent to which singular employers account for the majority of this employment in an area industry (and thus the extent to which the local labour market is vulnerable to that employer closing) will vary – I’m guessing that the University of Oxford accounts for a much greater proportion of employment in Oxford than the singular largest hotel or restaurant does in the Isles of Scilly.

So to look further at which employers dominate specific local labour markets, as well as to get more up to date information (Adzuna’s data is available in real time), we turn to the intelligence portal.

We first extract information on vacancy demand for each industry in the Standard Industrial Classification across each of the UK’s local authorities. Then, having identified instances where an industry dominates vacancy demand in an area, we take a closer look at which employers are responsible for this. We look at the job postings data covering 19/02/23 – 19/02/24. There are 11 instances where a single industry accounts for over 50% of vacancy demand within a single local authority. Three industries are responsible for these, so we’ll take a look into each of these in turn.

Before we do though, we should note a couple of things about the data. While we use local authorities as the local geographic unit under consideration, these do not directly correspond to local labour markets. Many individuals live and work in different local authorities, so identifying local authorities with vacancy demand concentrated among an industry / employer in this way doesn’t translate directly to the extent to which a local labour market is susceptible to the loss of a certain industry or employer, which is what we’re really interested in. We could have used the 2011 Travel to Work Areas, although these are somewhat out of date by now and as a simple exercise it’s perfectly fine to work with local authorities as long as this is kept in mind.

One other point to note is Adzuna is not able to assign an industry to all employers that have listings on the site. Some are too small and so the form of their activities are unknown. As such, we may overstate the share of employment held by big name employers whose industries are more likely to be known. There will also be some instances where the industry of the employer may be misclassified, but we assume this comes out in the wash.

So, let’s look at the areas which might be the most vulnerable to the closure of a single employer.

Public administration and defence

The public sector is responsible for the vast majority of instances where a single industry dominates vacancy demand in a local authority. Each of the instances where the public sector accounts for over 50% of vacancy demand happen to occur in relatively remote parts of Scotland.

In each of Aberdeenshire, Scottish Borders, East Lothian, North Ayrshire, Argyll and Bute, Shetland Islands and Orkney Islands, the respective local council is by far the largest employer. For most of these local authorities, the proportion of vacancy demand held by the public sector was 50-60%.

The highest share was held by the public sector in the Orkney Islands, at 79%. Additionally, whilst (correctly) classified as being an employer in the healthcare industry, the NHS (the relevant local trusts) is also among the top hiring employers in each of these areas.

Government budget cuts will naturally affect the creation of job opportunities in this industry in these locales, increasing the vulnerability of the local labour markets, although these employers are highly unlikely to close altogether reducing the chances of a Port Talbot Tata Steel type event.

Wholesale and retail

Three local authorities had their vacancy demand dominated by the wholesale and retail industry.

The highest share of vacancy demand held by the industry was in Mid-Ulster, at 61%. The areas’ top hiring employer was Terex, a manufacturer and retailer of wood processing, biomass and recycling equipment, which accounted for 18% of vacancy demand in the area. (This could be considered a misclassification as it appears they work with separate dealers who could be considered the wholesaler/ retailer for their products whilst Terex themselves are the manufacturer, although we don’t know enough about this company to say for certain). Other top hiring wholesalers and retailers in the area include Tesco, Poundland, Card Factory and Asda.

Ipswich is also an area where over half of vacancy demand is made up by the wholesale and retail industry, with the top five hiring employers over the period all being from the industry – the Co-operative Group, Tesco, Sofology, Kingfisher, and Sainsbury’s.

A leading candidate for the next potential Port Talbot could be Bolsover in the midlands. Vacancy demand here is dominated by one retailer in particular – the Frasers Group, whose headquarters and main warehouse and distribution centre in Shirebrook (within Bolsover) alone accounted for approximately 48% of vacancy demand in the area over the past year.

Bolsover is not unfamiliar with the effects felt by the decline of an industry with local importance, having previously been a significant coal mining area. Perhaps this case study might also offer insights into what might become of Port Talbot – an area centred on industries dominated by low paying, low quality job opportunities, like wholesale and retail, healthcare and hospitality.

Healthcare

The Forest of Dean is the one local authority where vacancy demand is dominated by the healthcare industry.

Seven of the top 10 hiring employers in the industry over the period were in this industry – Outcomes First Group, Voyage Care, The Orders of St John Care Trust, Brandon Trust, Freedom Leisure, National Care Group, and Ramsay Health Care UK Operations.

While the industry dominates demand in the area, as it is relatively evenly spread across industries this somewhat reduces the risk of the locale to the damaging effects associated with the closure of a single employer.

The next Port Talbot?

So of the areas identified above as being dominated by a specific industry, which might the most likely to be the next Port Talbot?

Well, given the high concentration of demand among a single employer, combined with the lack of stability that is inherent (to an extent) to the public sector, perhaps it is Bolsover. The continued cost of living crisis and weak economic situation might adversely affect the retail industry more so than others. Furthermore, at the end of last year, the Frasers Group announced plans to move their headquarters to Rugby in Warwickshire. Should this go ahead, this could have seriously adverse consequences on the creation of job opportunities within the local labour market.

Policymakers (both locally and nationally – parts of the UK lagging far behind others is cited as a leading factor behind our weak performance in recent times) need to pay close attention to these developments, with there potentially being a lot to do to help those who may lose their jobs as well as replacing those that may be lost.

Any views expressed are those of the author and not necessarily those of the Institute as a whole.